01022022 India, Investor Mindset:

- Is the idea great or execution?

- How to convert the elevator session into an opportunity?

- What is going on in an Investor’s mind?

- How to grab the investor attention?

- Are you on the right track?

The Indian StartUp Ecosystem observed a surge in investments in 2021, despite the pandemic, a positive trend that are a result of the government’s continuous thrust on the segment. Stalwarts recorded that nearly 41 billion USD was invested and almost 400% more than the last year where the investments were pegged around 11.5 billion USD.

And the data shows that nearly 396 seed Stage StartUps got funded while 166 scaling up got series a funding. All this places the country, globally as the third largest Unicorn producer with 90 of them nurtured. That’s again is the results of a fruitful action plan well structured by the architects of the nation.

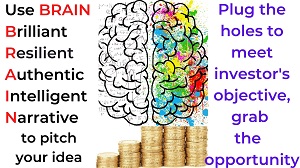

Now the point arises as to how to grab the opportunity to gain investments for a StartUp. We can well imagine that this is the ongoing thoughts of many founders across the country. Let’s probe on various aspects that could impact the investor’s mindset.

A perfect pitch deck that depicts the organization precisely increases the wow-factor in the listener’s mind, followed by a gripping narrative seals 50% of the deal.

What is a perfect Pitch: Start with an analysis on your customer whom you wish to serve, the target market. Then give details about the problems faced by them and how your product would solve their problem in the best way.

Move on to discuss about the competitive landscape and make a comparative SWOT analysis of your product keeping in view of the problems faced by the customer. Now talk about the solution offered in a crisp and clear fashion. The USP of the company would really impress the Investor at this point.

Then go on to talk about the Product-Market-Fit, quote the trends of the present times and how your product is the rightly awaited product in the market under the present scenario. How are you equipped to make this organization into a successful one! The details about the founders and strengths of the team will increase the confidence levels.

Then talk about the financials like market cap, your pricing. The document must hold a detailed analysis as to how you wish to reach determined levels at stipulated time lines. The market plan that is most precise and accurate has to be unfolded with a fool-proof plan behind. Take the vagaries in the marker into consideration while designing the strategy and of-course do discuss about the alternative plans as-well.

In the end discuss the ASK and the utility of the funds, put the team and developments before your own requirements. If the investor is investing their hard earned funds they expect the founders to dedicate their time as ideators and not just as employees.

The euphoria must be rightly set in that brings out the entrepreneur mindset in every team member. The organizational atmosphere must create a sense of security for the team that would help them shed inhibitions and explore newer opportunities. Such work culture would help the team visualize every problem as hidden challenges to prove their mettle. This would help the StartUp reach their goals in the fastest time.

Exercise to be done on the previous night to PITCH:

Certain Issues that need to be well analyzed by the Founding Team are:

- Why do you fail?

- How you lose vision & in turn interest?

- How many failures lead to success?

- Is iteration and pivoting necessary for your StartUp?

- How do you get an investor’s brownie?

- Which is more important the product or the market?

- How seasoned are you at pitching?

- Want to continue or make a lucrative exit?

These Points well answered would reap well defined and most wanted results at the pitching sessions.

Now let’s look at the other side of the coin, What are the investor’s lucrative pointers that are non-negotiable:

- Is there a wow factor!

- Has the founder well assessed the market?

- Is the product backed by a strong marketing directive?

- How well is the team comprised off?

- Have they gone through the market validation in the right manner or have they been working on the idea only.

Because most investors want to know whether the team have dirtied their hands on the field and found out the feedback to iterate or pivot in the initial days. This shows the volatility of the team and sends in a strong ethos that the team is ready to work 360 degrees to give the best in designing the final product. Hey Investor! What else do you need to make a lucrative investment?

A personal note from WAY2WORLD: Please like our pages: on Facebook & LinkedIn. #Way2World brings #StartUpNews from #StartUpResources about #StartUpFounders, #Co-Founders, #WomenEntrepreneurs, #WomenLeaders, #StartUpMentors, #StartUpInnovation #StartUpIncubators, #StartUpAccelerators and #StartUpListing. The #StartUpArticles, #StartUpReviews and #StartUpStories discuss about #StartUpFunding, #IndianStart-Ups their #BusinessServices along with #StartUpName and #technologyimpactness. With Inputs from internet – RajKishan